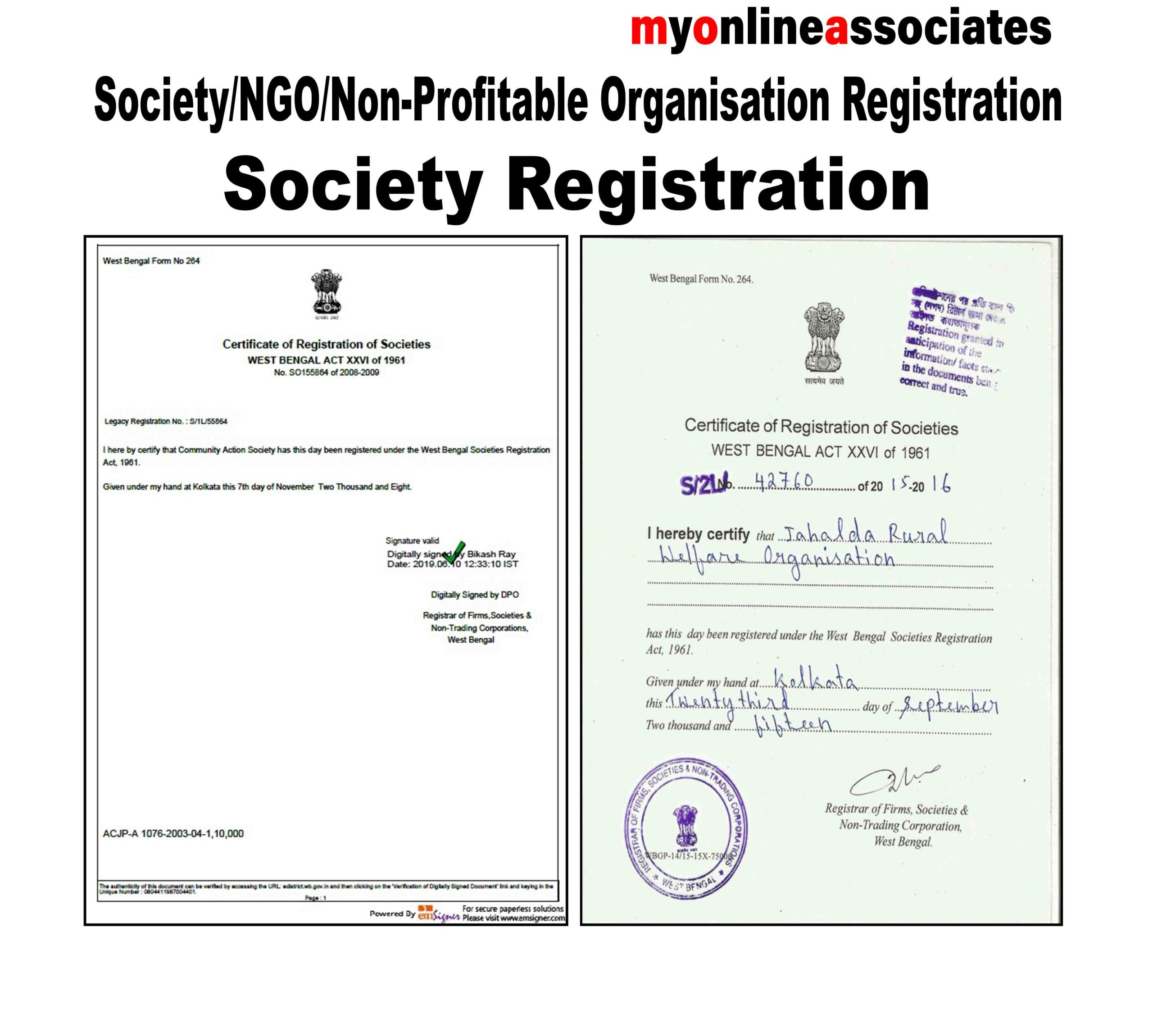

Society / NGO / Non-Profit Organization (NPO) Registration – Description

Society, NGO, or Non-Profit Organization (NPO) Registration is the legal process of forming an organization dedicated to social, charitable, religious, educational, or cultural activities. These entities do not operate for profit and aim to serve society.

Purpose of Society/NGO/NPO Registration:

-

Legal Recognition – Provides a distinct legal identity to the organization.

-

Tax Benefits & Exemptions – Enables eligibility for tax exemptions under Section 12A & 80G of the Income Tax Act.

-

Access to Government Grants & Foreign Donations – Facilitates funding through CSR, government grants, and FCRA.

-

Trust & Credibility – Enhances public confidence and helps in fundraising.

-

Property & Asset Protection – Allows the organization to acquire property in its name.

Types of Non-Profit Organizations in India:

-

Society – Registered under the Societies Registration Act, 1860 for charitable, literary, and scientific purposes.

-

Trust – Registered under the Indian Trusts Act, 1882 for religious and social causes.

-

Section 8 Company – Registered under the Companies Act, 2013, for non-profit business activities like education, charity, and environment protection.

Registration Process for Different Entities:

1. Society Registration

-

Minimum 7 members required.

-

Apply under the Societies Registration Act, 1860 at the state Registrar office.

-

Governing body must draft a Memorandum of Association (MoA) and Rules & Regulations.

2. Trust Registration

-

Requires a Trust Deed with settlor and trustees.

-

Registered under the Sub-Registrar office of the relevant state.

-

Suitable for charitable & religious trusts.

3. Section 8 Company Registration

-

Apply through Ministry of Corporate Affairs (MCA).

-

Requires Directors Identification Number (DIN) & Digital Signature Certificate (DSC).

-

Submit MoA, AoA (Articles of Association), and declaration for non-profit objectives.

Documents Required for Registration:

✔ PAN & Aadhaar of founders/trustees/members

✔ Address proof of office (rent agreement, utility bill)

✔ MoA & Rules/Regulations (for societies)

✔ Trust Deed (for trusts)

✔ Declaration of Non-Profit Objective (for Section 8 companies)

Tax Benefits & Compliance:

✅ 12A Registration – Tax exemption on income.

✅ 80G Certification – Tax benefits for donors.

✅ FCRA Registration – Required for receiving foreign donations.

Reviews

There are no reviews yet.