Income Tax Filing – Description

Income Tax Filing is the process of submitting your income details to the Income Tax Department of India to determine tax liability or refunds. It is a mandatory process for individuals, businesses, and organizations earning taxable income in a financial year. Tax returns are filed using an Income Tax Return (ITR) form based on income sources and taxpayer category.

Purpose of Income Tax Filing:

-

Legal Compliance – Mandatory under the Income Tax Act, 1961.

-

Avoid Penalties – Late or non-filing can lead to fines or legal action.

-

Claim Tax Refunds – Get refunds on excess tax deducted (TDS).

-

Loan & Visa Approvals – Banks and embassies require ITRs for verification.

-

Carry Forward Losses – Allows taxpayers to adjust losses against future profits.

Who Needs to File an ITR?

✅ Individuals earning above the basic exemption limit (₹2.5 lakh for individuals, ₹3 lakh for senior citizens).

✅ Businesses & Professionals with income above the prescribed limit.

✅ Companies, LLPs, Trusts, and NGOs, regardless of profit or loss.

✅ Freelancers & Self-Employed Individuals exceeding taxable income.

✅ NRI & Foreign Income Earners meeting tax conditions.

Types of ITR Forms & Eligibility:

| ITR Form | Applicable For |

|---|---|

| ITR-1 (Sahaj) | Salaried individuals with income up to ₹50 lakh, one house property, and other limited sources. |

| ITR-2 | Individuals & HUFs (Hindu Undivided Families) with income above ₹50 lakh or capital gains. |

| ITR-3 | Business owners & professionals. |

| ITR-4 (Sugam) | Presumptive taxation for small businesses & professionals (up to ₹2 crore turnover). |

| ITR-5 | Partnership firms, LLPs, associations. |

| ITR-6 | Companies (except those claiming tax exemption under Section 11). |

| ITR-7 | Trusts, NGOs, and institutions under Sections 139(4A) to 139(4D). |

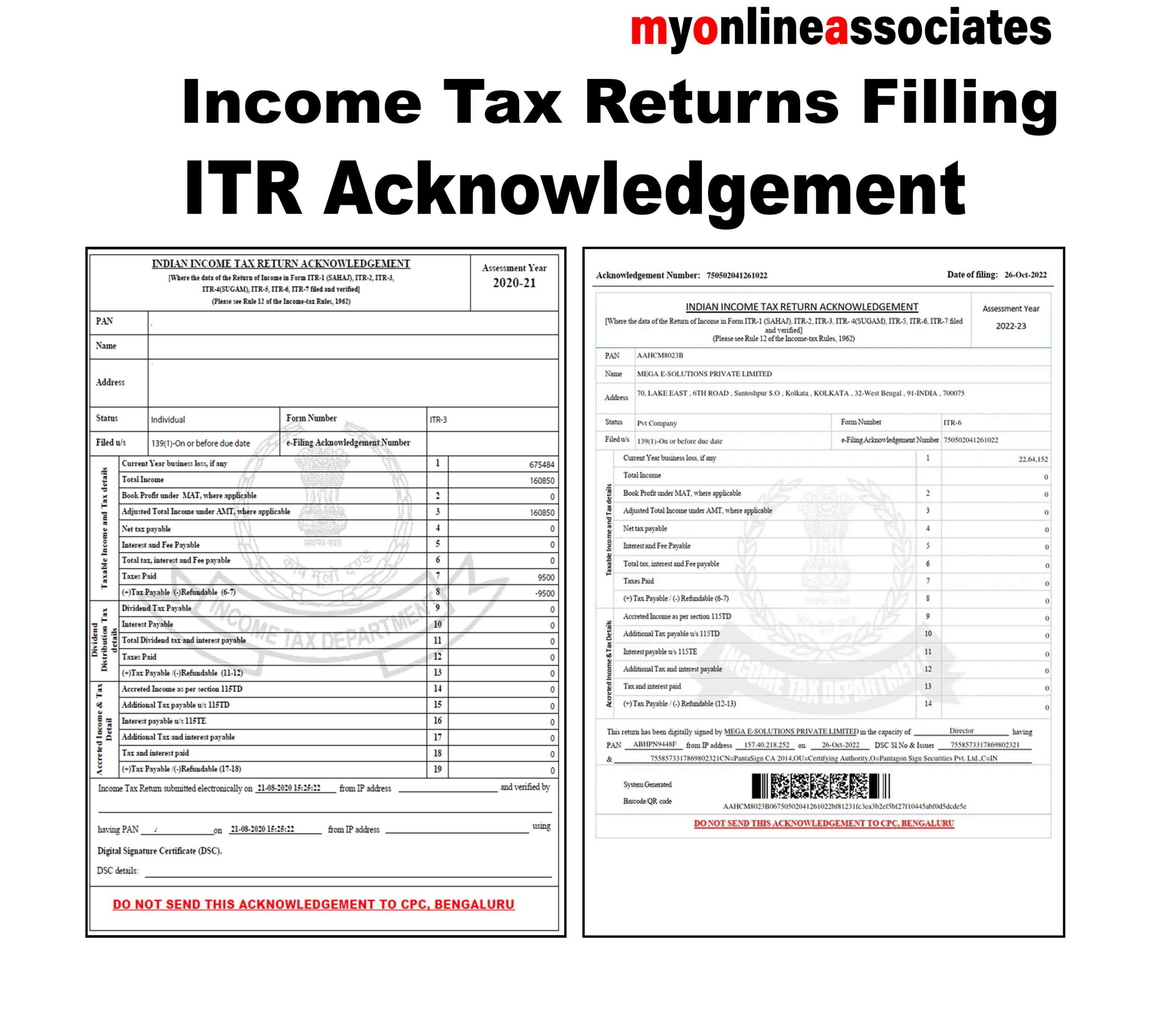

How to File Income Tax Returns?

-

Gather Required Documents (PAN, Aadhaar, Form 16, Form 26AS, bank statements, investment proofs).

-

Login to the Income Tax e-Filing Portal (www.incometax.gov.in).

-

Select the Appropriate ITR Form based on income type.

-

Fill in Income & Deduction Details (Salary, business income, capital gains, exemptions).

-

Verify Tax Calculation and pay any outstanding tax, if applicable.

-

Submit the ITR & Verify (via Aadhaar OTP, net banking, or offline by sending a signed ITR-V to CPC, Bangalore).

-

Receive Acknowledgment & Processing Status from the IT Department.

Due Dates for ITR Filing (FY 2023-24):

-

Individuals & Non-Audit Cases – July 31, 2024

-

Businesses Requiring Audit – October 31, 2024

-

Companies & Firms Filing Transfer Pricing Reports – November 30, 2024

Penalties for Late Filing:

-

₹1,000 (income below ₹5 lakh).

-

₹5,000 (income above ₹5 lakh).

-

Additional interest under Section 234A, 234B & 234C for tax dues.

Reviews

There are no reviews yet.