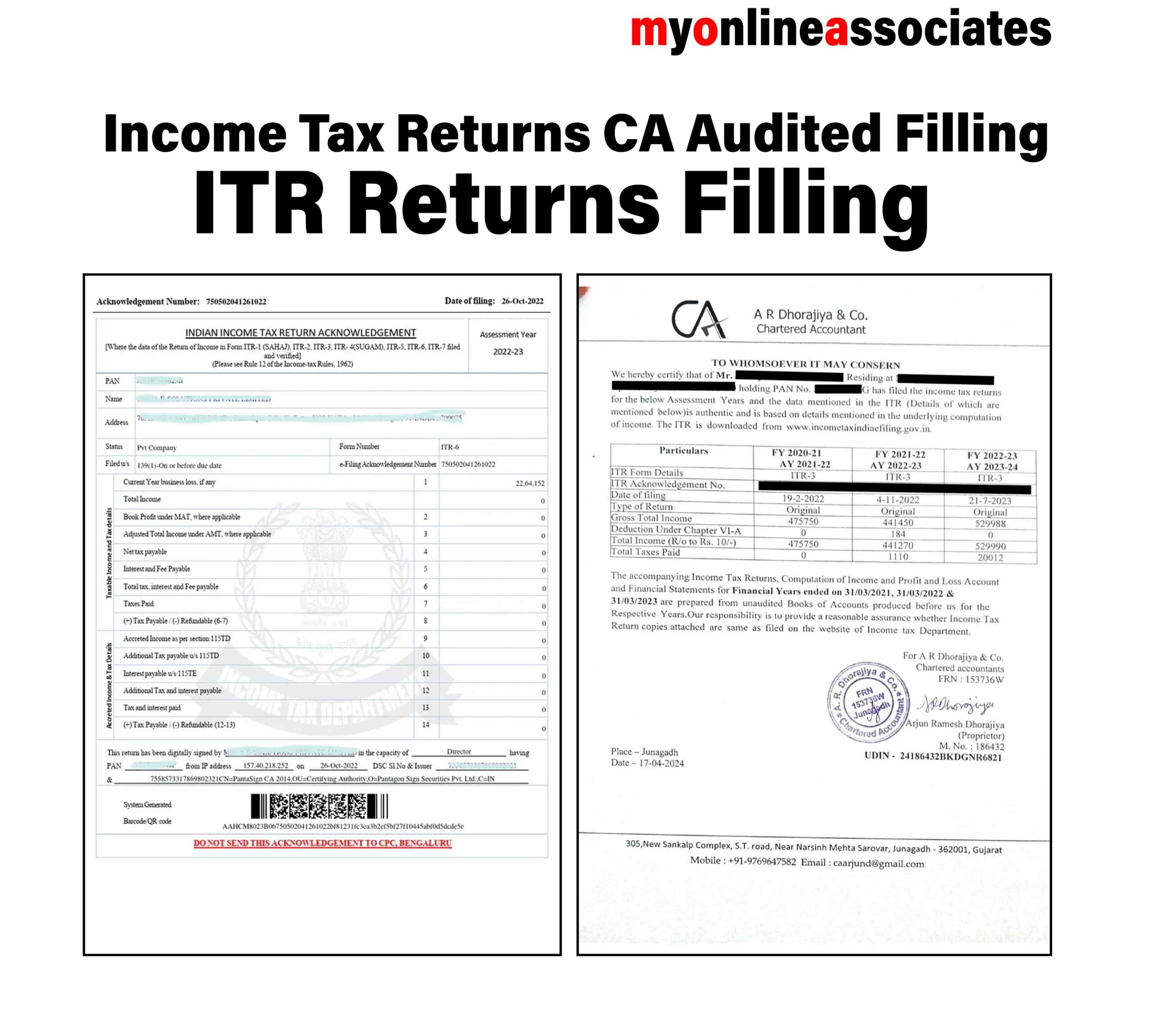

Income Tax Return (ITR) Filing – Audited File

ITR Filing with Audit is the process of submitting audited financial statements along with the income tax return for businesses and professionals who meet certain criteria under the Income Tax Act, 1961. Audit ensures the accuracy of financial records and tax compliance. The audit is conducted by a Chartered Accountant (CA) and filed with the Income Tax Department.

Who Needs to File an Audited ITR?

Income tax audit is mandatory in the following cases:

1. Businesses (Under Section 44AB)

✅ Turnover above ₹1 crore (₹10 crore if cash transactions ≤ 5%).

✅ Presumptive Taxation Scheme (44AD) – If turnover is up to ₹2 crore but profit is below 8% (cash) or 6% (digital transactions).

2. Professionals (Under Section 44AB)

✅ Gross receipts above ₹50 lakh in a financial year.

✅ Presumptive Taxation Scheme (44ADA) – If receipts are up to ₹50 lakh but profit is below 50%.

3. LLPs and Companies

✅ All Companies & LLPs must file audited ITR, irrespective of profit or turnover.

4. Entities Covered Under Other Tax Audits

✅ Foreign businesses operating in India.

✅ Trusts, NGOs, and political parties if tax audit conditions apply.

Types of ITR Forms for Audited Filings

| ITR Form | Applicable For |

|---|---|

| ITR-3 | Professionals & Business Owners under Audit |

| ITR-5 | Partnership Firms, LLPs |

| ITR-6 | Companies (except those claiming exemption under Sec 11) |

| ITR-7 | Trusts, NGOs, and entities under Sections 139(4A) to 139(4D) |

Process of Filing an Audited ITR

✅ Step 1: Prepare Financial Statements (Profit & Loss, Balance Sheet, Cash Flow).

✅ Step 2: Get the Accounts Audited by a CA.

✅ Step 3: Obtain Audit Report in Form 3CA/3CB & Form 3CD.

✅ Step 4: File ITR Online at Income Tax e-Filing Portal.

✅ Step 5: Verify the Return using Aadhaar OTP, DSC, or EVC.

Due Date for Audited ITR Filing (FY 2023-24)

📅 Businesses & Professionals Requiring Audit – October 31, 2024

📅 Companies & Firms Filing Transfer Pricing Reports – November 30, 2024

Penalty for Not Filing an Audited ITR

🚨 Late Audit Submission: ₹1.5 lakh or 0.5% of turnover (Sec 271B).

🚨 Late ITR Filing: ₹5,000 (₹1,000 if income < ₹5 lakh).

🚨 Interest Charges: 1% per month on unpaid taxes (Sec 234A, 234B, 234C).

Benefits of Filing an Audited ITR

✔ Avoid penalties & legal issues.

✔ Claim tax deductions & benefits under business tax laws.

✔ Enhances business credibility for loans & investors.

✔ Complies with regulatory requirements for businesses & professionals.

Reviews

There are no reviews yet.