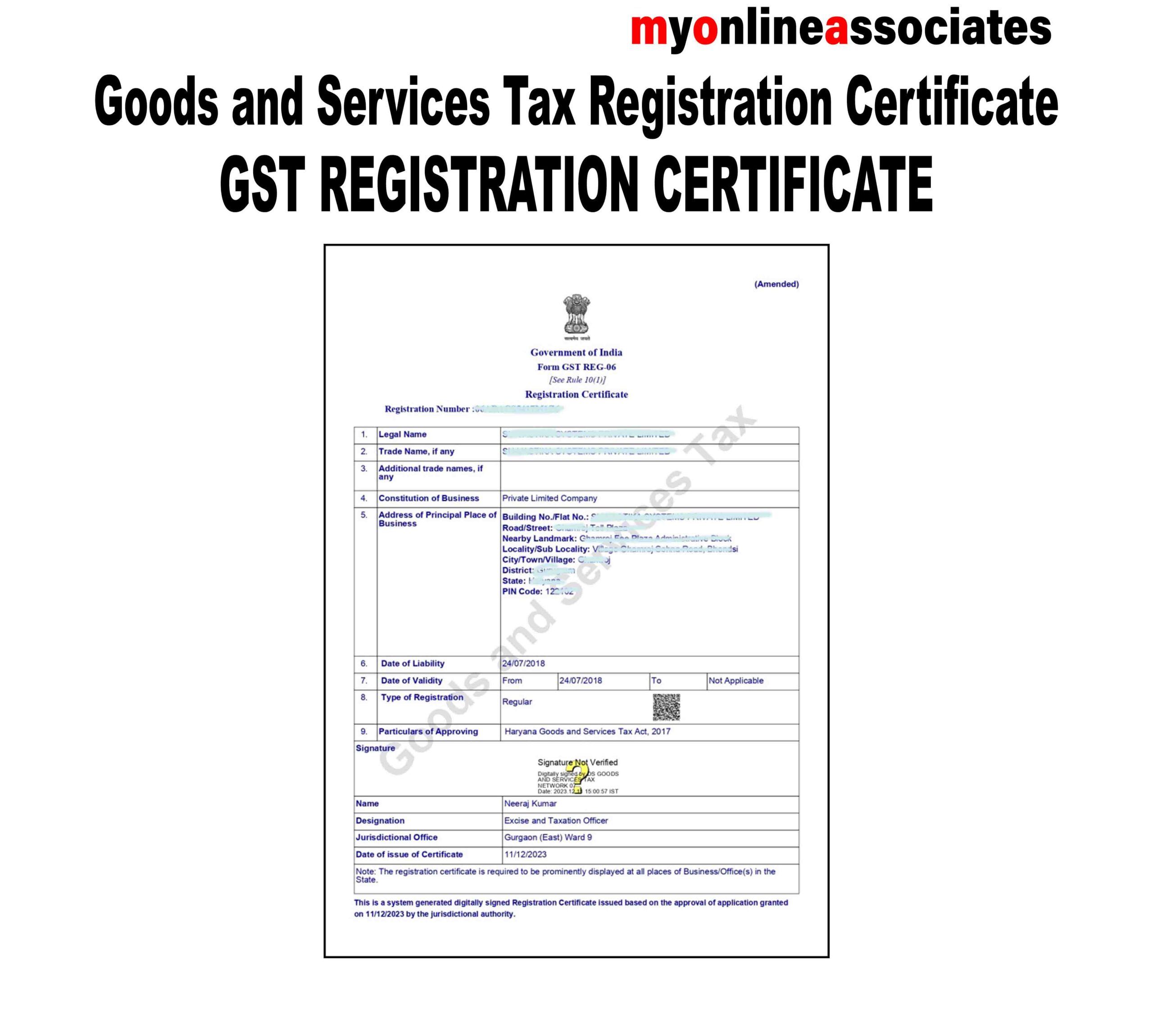

Goods and Services Tax (GST) Registration – Description

GST Registration is the process of obtaining a unique Goods and Services Tax Identification Number (GSTIN) from the Goods and Services Tax Network (GSTN). It is mandatory for businesses and individuals involved in the supply of goods and services beyond a specified turnover limit. GST registration allows businesses to collect and remit GST to the government.

Purpose of GST Registration:

✅ Legal Compliance – Ensures that businesses comply with GST laws under the CGST Act, 2017.

✅ Avoids Penalties – Unregistered businesses exceeding the threshold may face fines.

✅ Input Tax Credit (ITC) Benefits – Businesses can claim credit for GST paid on purchases.

✅ Enhances Business Credibility – A GSTIN improves trust and allows interstate trade.

✅ Mandatory for E-Commerce & Exporters – Required for selling online or exporting goods.

Who Needs to Register for GST?

-

Businesses with turnover above the threshold:

-

₹40 lakh (goods) & ₹20 lakh (services) for most states.

-

₹10 lakh for North-Eastern & Special Category States.

-

-

E-commerce Sellers (Amazon, Flipkart, etc.).

-

Interstate Suppliers (Businesses selling across state borders).

-

Casual Taxable Persons (Temporary businesses at exhibitions or fairs).

-

Input Service Distributors (ISD) and Reverse Charge Mechanism (RCM) payers.

Types of GST Registration:

-

Regular GST Registration – For businesses exceeding the threshold.

-

Composition Scheme Registration – For small businesses with turnover up to ₹1.5 crore (less compliance, lower tax rates).

-

Casual & Non-Resident Registration – For temporary businesses or foreign entities supplying goods/services in India.

How to Register for GST?

-

Visit the GST Portal – www.gst.gov.in and click on New Registration.

-

Fill in Business Details – PAN, name, contact details, and state of operation.

-

Upload Required Documents:

-

PAN & Aadhaar of owner/partners.

-

Business registration proof (Partnership Deed, Incorporation Certificate).

-

Address proof (Rent agreement, Electricity bill).

-

Bank account details.

-

-

Verify with OTP & Submit Application.

-

Receive GSTIN & Certificate upon approval.

Documents Required for GST Registration:

✔ PAN & Aadhaar of proprietor/partners/directors.

✔ Business Incorporation Certificate (for companies & LLPs).

✔ Address Proof of Business (Electricity bill, Rent Agreement).

✔ Bank Account Details (Cancelled cheque, Bank statement).

✔ Digital Signature Certificate (DSC) (for companies & LLPs).

Post-Registration Compliance:

📌 Monthly/Quarterly GST Returns (GSTR-1, GSTR-3B, etc.).

📌 Payment of GST dues & claiming Input Tax Credit (ITC).

📌 Annual GST Return Filing (GSTR-9) for businesses above ₹2 crore turnover.

📌 E-Way Bill generation for inter-state transport of goods above ₹50,000 value.

Reviews

There are no reviews yet.