Goods and Services Tax (GST) Returns Filing – Description

GST Return Filing is the process of submitting a summary of sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax credit) to the Goods and Services Tax Network (GSTN). It ensures proper tax compliance under the Goods and Services Tax (GST) Act, 2017.

Purpose of GST Return Filing:

✅ Legal Compliance – Mandatory for registered businesses under GST law.

✅ Claim Input Tax Credit (ITC) – Helps businesses reduce tax liability by claiming ITC.

✅ Avoid Penalties – Non-filing leads to fines and interest charges.

✅ Enables Business Operations – Required for businesses to maintain GST compliance and continue operations.

✅ Transparency & Accountability – Ensures accurate tax collection and prevents fraud.

Who Needs to File GST Returns?

✔ All GST-registered businesses (Regular, Composition, Exporters, E-commerce, etc.).

✔ Service providers, traders, and manufacturers with GST registration.

✔ E-commerce operators & sellers registered under GST.

✔ Input Service Distributors (ISD) & businesses under Reverse Charge Mechanism (RCM).

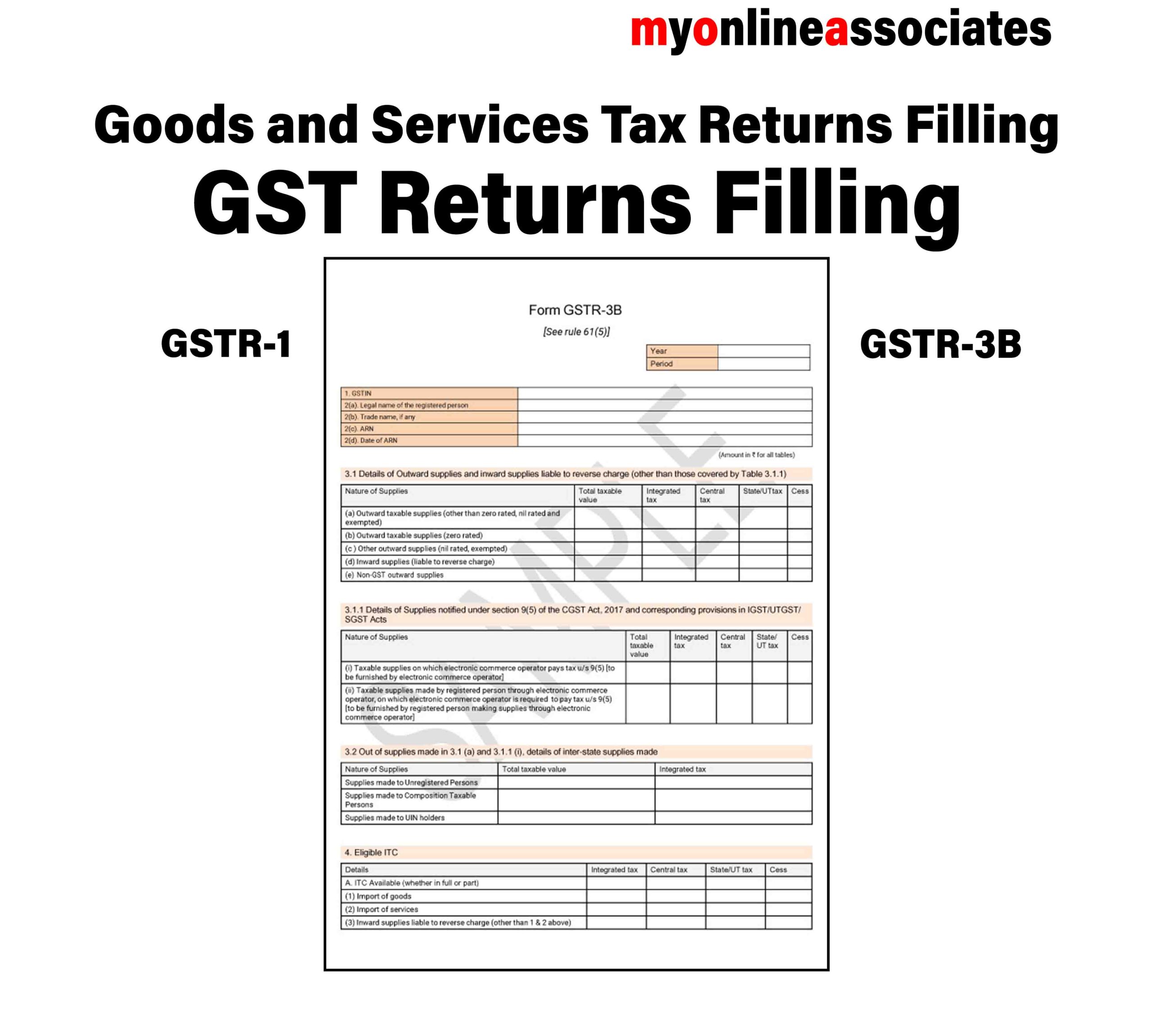

Types of GST Returns & Their Due Dates

| GST Return Form | Applicable For | Filing Frequency | Due Date |

|---|---|---|---|

| GSTR-1 | Summary of outward supplies (sales) | Monthly/Quarterly | 11th of next month (Monthly) / 13th of next quarter (QRMP) |

| GSTR-3B | Summary of outward & inward supplies, tax payment | Monthly | 20th of next month |

| GSTR-4 | For Composition Scheme taxpayers | Annually | 30th April of the next financial year |

| GSTR-5 | For Non-Resident Foreign Taxpayers | Monthly | 20th of next month |

| GSTR-6 | For Input Service Distributors (ISD) | Monthly | 13th of next month |

| GSTR-7 | For Tax Deducted at Source (TDS) deductors | Monthly | 10th of next month |

| GSTR-8 | For E-commerce Operators (TCS collection) | Monthly | 10th of next month |

| GSTR-9 | Annual GST Return for regular taxpayers | Annually | 31st December of next financial year |

| GSTR-9C | GST Audit Return for businesses with turnover above ₹5 crore | Annually | 31st December of next financial year |

Steps to File GST Returns Online

1️⃣ Login to GST Portal – www.gst.gov.in

2️⃣ Select the relevant GST return form (GSTR-1, GSTR-3B, etc.).

3️⃣ Enter sales, purchases, tax collected, and input tax credit details.

4️⃣ Verify and reconcile data with GSTR-2A & GSTR-2B (auto-generated purchase details).

5️⃣ Pay GST dues (if applicable) using net banking, UPI, or credit ledger.

6️⃣ Submit and e-verify return using DSC, OTP, or EVC.

7️⃣ Download the acknowledgment receipt.

Penalty for Late Filing of GST Returns

🚨 Late Fees:

-

₹50 per day (₹25 CGST + ₹25 SGST) for regular taxpayers.

-

₹20 per day (₹10 CGST + ₹10 SGST) for NIL returns.

🚨 Interest Charges:

-

18% per annum on the pending tax amount.

Benefits of Timely GST Return Filing

✔ Avoid penalties and maintain a clean compliance record.

✔ Seamless Input Tax Credit (ITC) claims to reduce tax liability.

✔ Improves business credibility for loans and partnerships.

✔ Necessary for businesses involved in government tenders and contracts.

Reviews

There are no reviews yet.