Estimated Balance Sheet & Profit and Loss Account

An Estimated Balance Sheet & Profit and Loss Account is a provisional financial statement prepared based on projected income, expenses, assets, and liabilities for a future period. These estimates help businesses in financial planning, loan applications, and tax assessments.

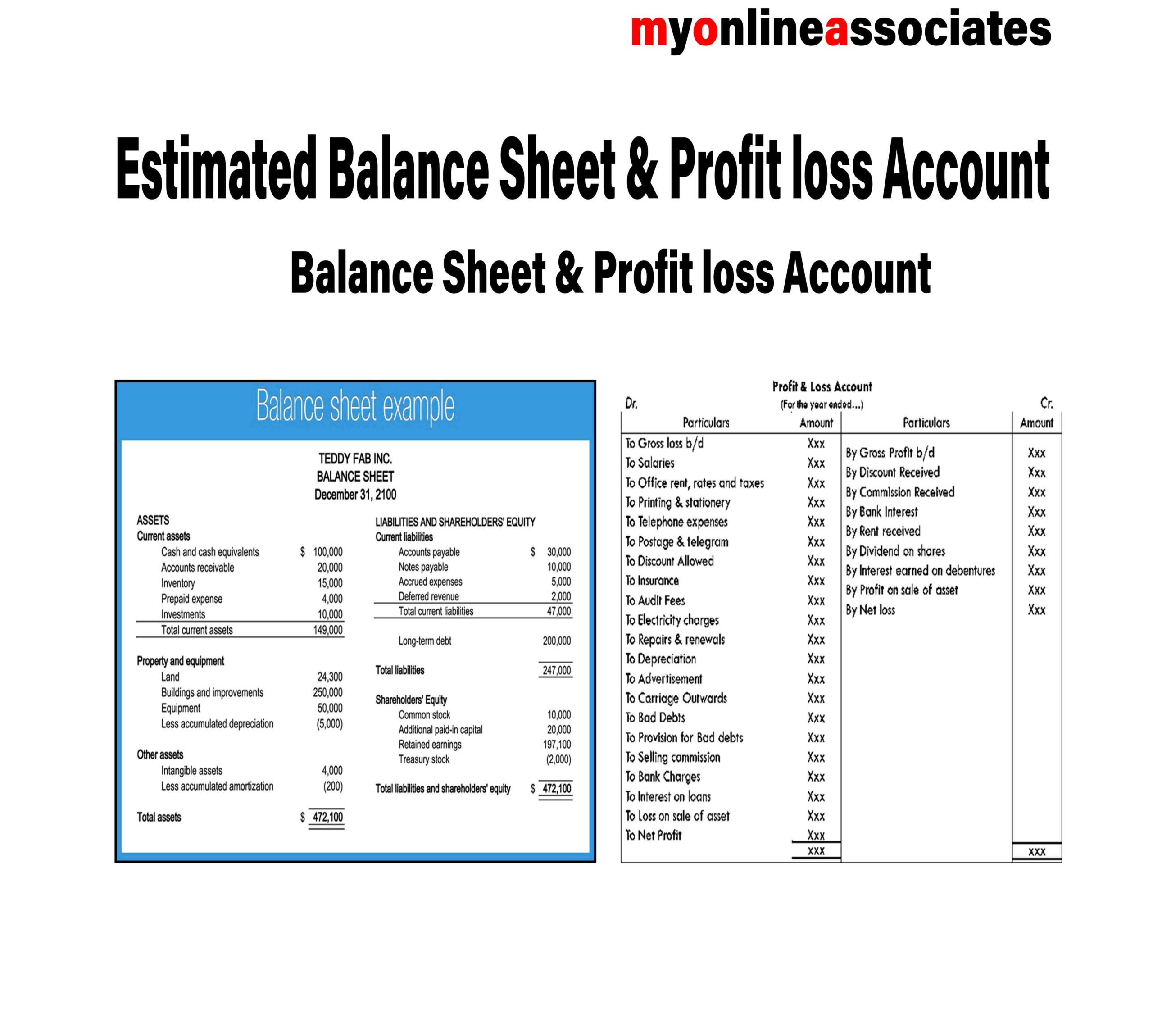

1. Estimated Balance Sheet

An Estimated Balance Sheet presents a forecast of assets, liabilities, and equity for a specific date in the future. It helps businesses understand their expected financial position and plan investments or funding.

Format of an Estimated Balance Sheet

| Particulars | Amount (₹) |

|---|---|

| Assets: | |

| Fixed Assets (Machinery, Equipment) | XXX |

| Current Assets (Cash, Inventory, Debtors) | XXX |

| Investments | XXX |

| Total Assets | XXX |

| Liabilities & Equity: | |

| Loan & Borrowings | XXX |

| Creditors (Payables) | XXX |

| Owner’s Equity (Capital + Retained Earnings) | XXX |

| Total Liabilities & Equity | XXX |

2. Estimated Profit & Loss Account

An Estimated Profit & Loss Account predicts the future income and expenses of a business over a specific period (monthly, quarterly, or yearly). It helps businesses set revenue targets and control costs.

Format of an Estimated Profit & Loss Account

| Particulars | Amount (₹) |

|---|---|

| Revenue: | |

| Sales Revenue | XXX |

| Other Income (Interest, Rent) | XXX |

| Total Revenue | XXX |

| Expenses: | |

| Cost of Goods Sold (COGS) | XXX |

| Operating Expenses (Rent, Salaries, Marketing) | XXX |

| Depreciation | XXX |

| Interest & Taxes | XXX |

| Total Expenses | XXX |

| Net Profit (Revenue – Expenses) | XXX |

Purpose of an Estimated Balance Sheet & P&L Account:

✅ Loan & Investment Applications – Required for bank loans & investor funding.

✅ Business Planning – Helps in forecasting revenue & controlling expenses.

✅ Tax Compliance & GST Filing – Used for advance tax payments & audits.

✅ Financial Decision-Making – Helps businesses assess profitability & growth potential.

Reviews

There are no reviews yet.