Balance Sheet & Profit and Loss Account – Description

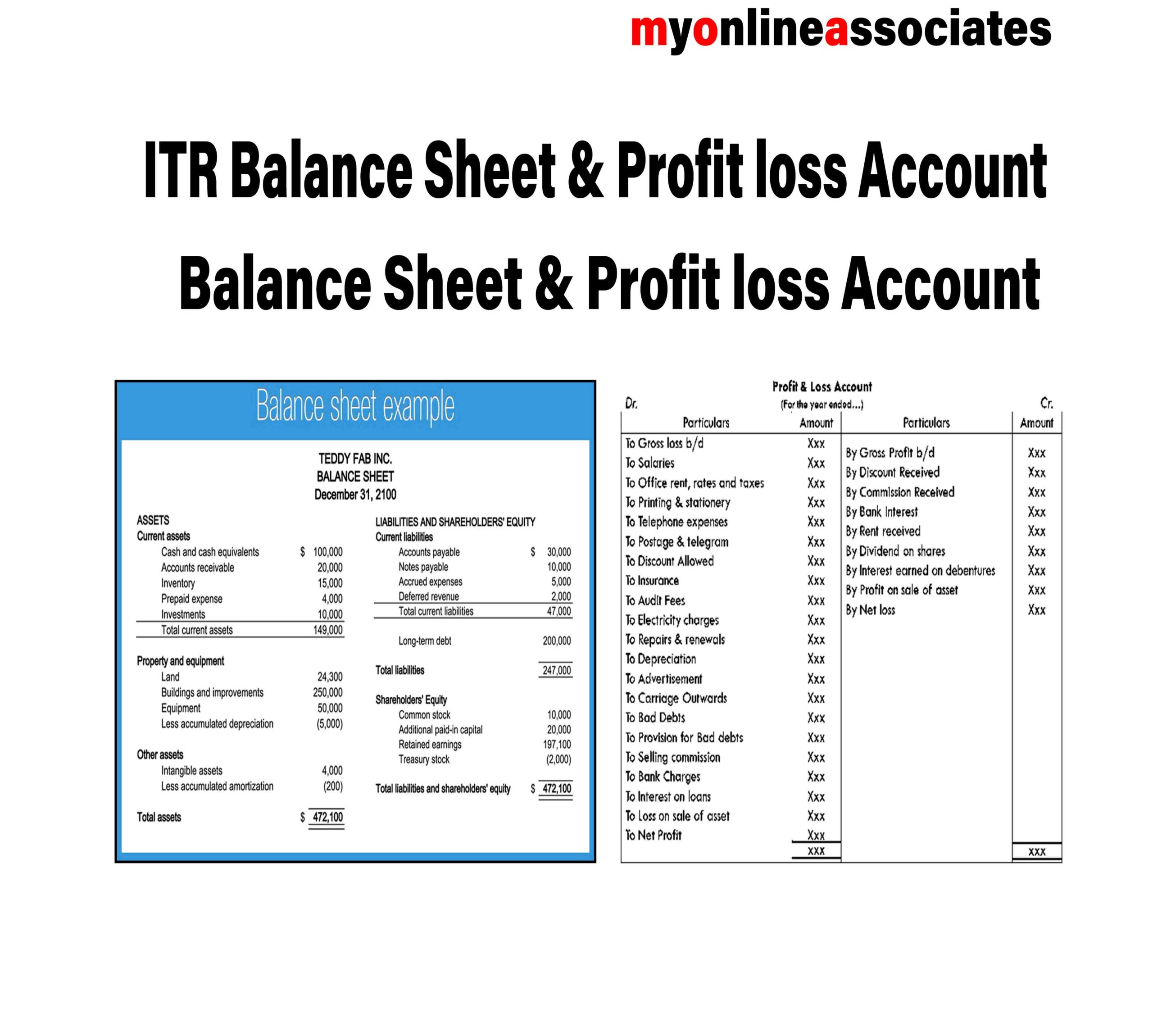

1. Balance Sheet

A Balance Sheet is a financial statement that provides a snapshot of a company’s financial position at a specific date. It shows what the business owns (assets) and what it owes (liabilities), along with the owner’s equity.

Key Components of a Balance Sheet:

✅ Assets – Resources owned by the company (e.g., Cash, Inventory, Equipment).

✅ Liabilities – Financial obligations (e.g., Loans, Creditors, Taxes Payable).

✅ Equity – Owner’s capital & retained earnings (Net worth of the business).

Formula:

📝 Assets = Liabilities + Owner’s Equity

2. Profit and Loss (P&L) Account

A Profit and Loss Account (Income Statement) shows a company’s financial performance over a period (monthly, quarterly, or yearly). It summarizes revenue, expenses, and net profit/loss.

Key Components of P&L Account:

✅ Revenue – Total income from sales/services.

✅ Cost of Goods Sold (COGS) – Direct costs of producing goods/services.

✅ Gross Profit – Revenue minus COGS.

✅ Operating Expenses – Rent, salaries, marketing, etc.

✅ Net Profit/Loss – Final profit after all expenses & taxes.

Formula:

📝 Net Profit = Revenue – Expenses

Purpose of Balance Sheet & P&L Account:

✔ Helps in financial decision-making & business growth planning.

✔ Required for loans, investor funding, & tax compliance.

✔ Used in ITR filing, GST returns, & audits.

✔ Determines the profitability & financial health of a business.

Reviews

There are no reviews yet.