TDS Claimed File – Description

TDS (Tax Deducted at Source) Claimed File refers to the process of claiming credit for TDS deducted by employers, clients, or banks while filing the Income Tax Return (ITR). The TDS credit can be adjusted against total tax liability, and if excess TDS has been deducted, a refund is issued by the Income Tax Department.

Purpose of TDS Claiming:

✅ Adjust TDS against total tax liability to reduce the payable tax.

✅ Claim a refund if excess TDS has been deducted.

✅ Ensure accurate tax filing as per Form 26AS & AIS (Annual Information Statement).

✅ Avoid double taxation by ensuring deducted tax is correctly credited.

Who Can Claim TDS?

✔ Salaried employees whose employer deducts TDS from salary.

✔ Freelancers & Professionals receiving payments after TDS deduction.

✔ Business owners subjected to TDS on invoices or service payments.

✔ Fixed deposit (FD) holders where banks deduct TDS on interest (10%).

✔ Rent recipients where tenants deduct TDS on rent (5%).

✔ NRIs whose Indian income has TDS deducted.

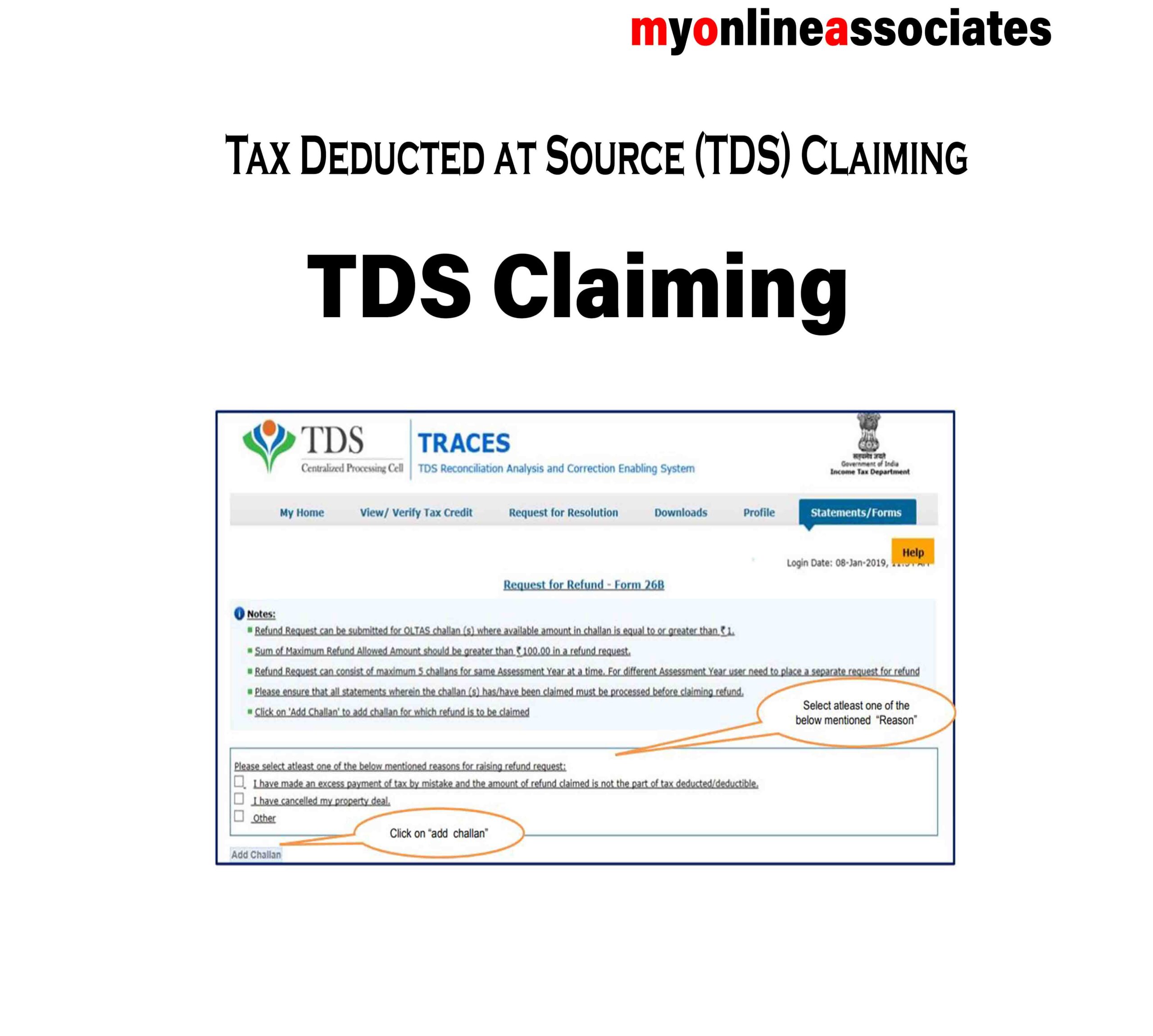

Steps to Claim TDS While Filing ITR:

1️⃣ Check Form 26AS & AIS at Income Tax e-Filing Portal to verify TDS details.

2️⃣ Match TDS with Form 16 (Salary) or Form 16A (Other Income Sources).

3️⃣ Select the correct ITR Form based on income type (ITR-1, ITR-2, etc.).

4️⃣ Enter TDS details under ‘Tax Paid & Verification’ section.

5️⃣ Verify the Pre-Filled Data with actual deductions made.

6️⃣ File ITR & Claim Refund (if excess TDS is deducted).

7️⃣ Verify Return using Aadhaar OTP, DSC, or EVC.

Documents Required for TDS Claim:

📌 Form 16 (For Salaried Employees).

📌 Form 16A (For TDS on Other Incomes like FD Interest, Rent, etc.).

📌 Form 26AS (Tax Credit Statement from Income Tax Portal).

📌 Bank Statements & Salary Slips.

Processing Time for TDS Refund

⏳ 30-45 days after ITR verification & processing by the Income Tax Department.

Penalty for Not Claiming TDS

🚨 Unclaimed TDS is lost if not adjusted/refunded within the allowed time.

🚨 Mismatch in Form 26AS can lead to tax notices & delays in refunds.

Reviews

There are no reviews yet.