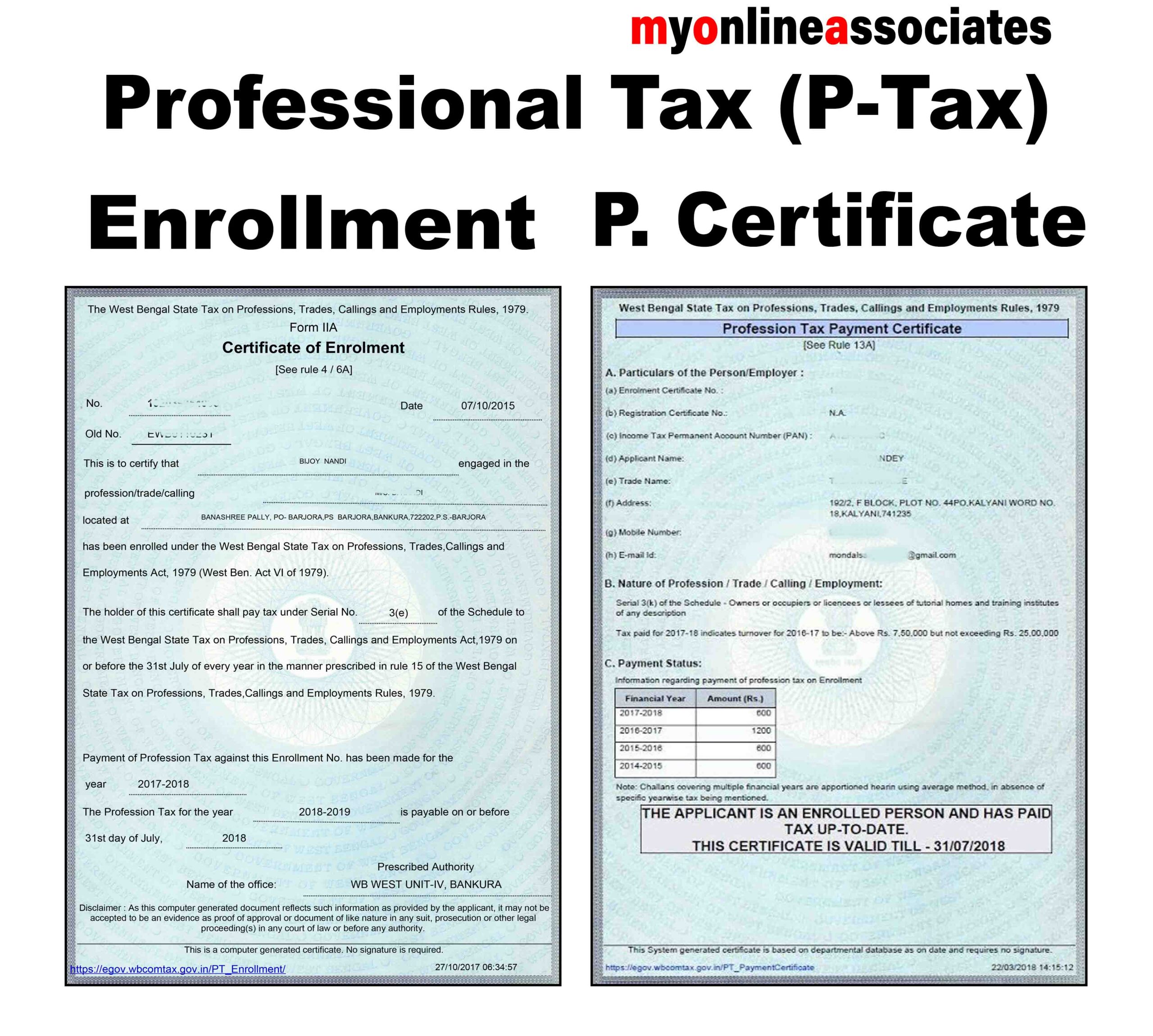

Professional Tax Fee – Description

Professional Tax (PT) is a state-imposed tax levied on individuals and entities engaged in professions, trades, and employment. It is deducted from an individual’s salary or paid directly by self-employed professionals and businesses. The tax is regulated by the respective state or municipal authority and varies by location.

Who Pays Professional Tax?

-

Salaried Individuals – Employers deduct PT from employees’ salaries and remit it to the government.

-

Self-Employed Professionals – Individuals like doctors, lawyers, consultants, freelancers, and business owners pay PT directly.

-

Business Entities – Companies and firms may also be liable for professional tax.

Professional Tax Fee Structure

-

The fee is usually slab-based, meaning the amount varies depending on income or turnover.

-

Some states impose a monthly, quarterly, or annual PT fee.

-

The maximum PT charged per individual is typically capped at ₹2,500 per year in India.

Professional Tax Registration & Payment

-

Employers – Must register with the state’s professional tax department and deduct PT from employees’ salaries.

-

Self-Employed Professionals – Need to register and pay PT as per state regulations.

-

Due Dates – PT is usually paid on a monthly, quarterly, or annual basis, depending on the state’s rules.

-

Penalties for Non-Payment – Failure to pay PT on time may result in fines, interest, or legal action.

Reviews

There are no reviews yet.