Projected Balance Sheet & Profit and Loss Account – Description

A Projected Balance Sheet & Profit and Loss (P&L) Account is a financial forecast that estimates a company’s future financial position and performance based on expected revenues, expenses, assets, and liabilities. Businesses use these projections for planning, budgeting, loan applications, investor reports, and strategic decision-making.

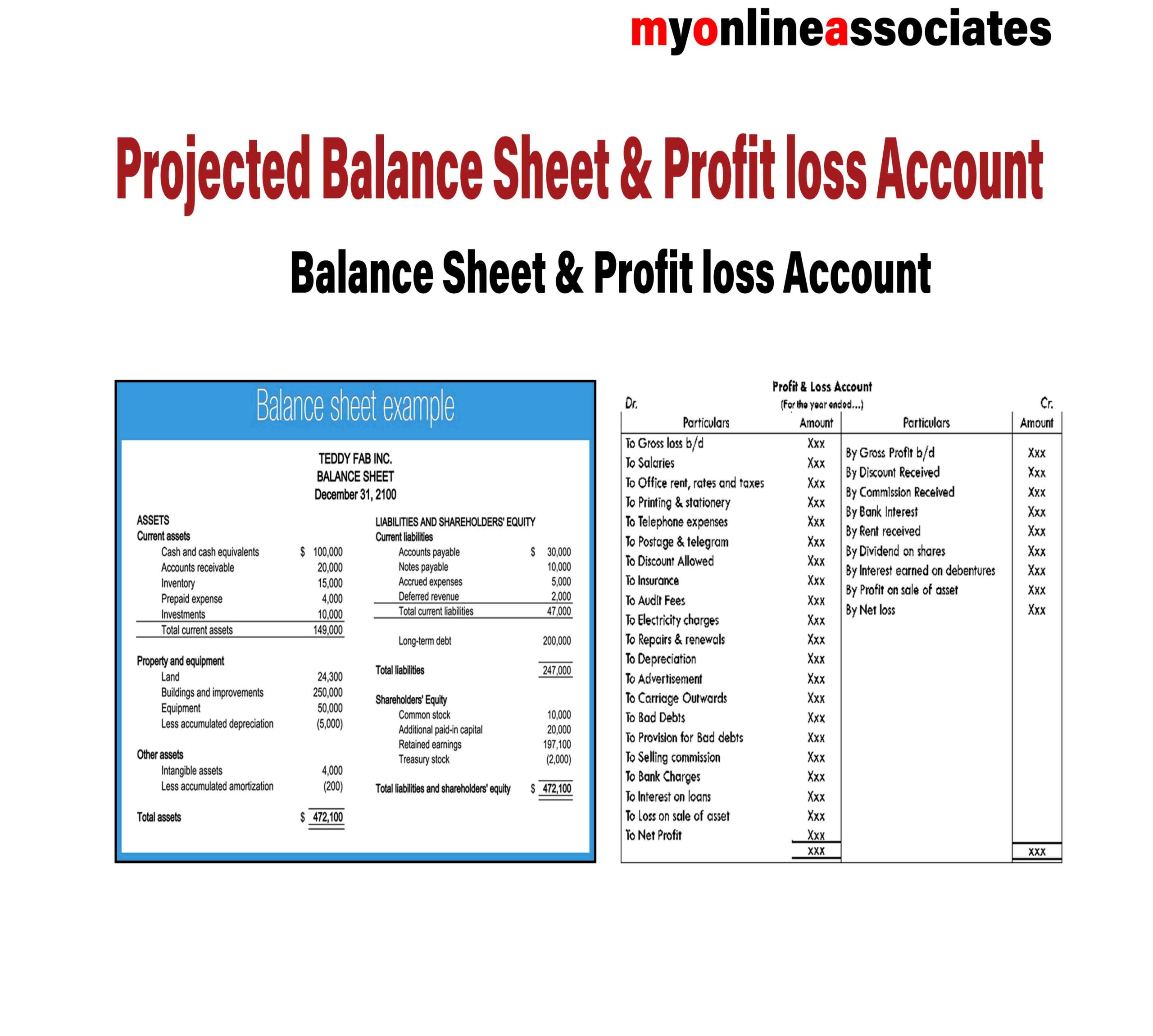

1. Projected Balance Sheet

A Projected Balance Sheet predicts the financial position of a business at a future date. It helps in assessing the expected assets, liabilities, and equity and ensures financial stability for growth and expansion.

Format of a Projected Balance Sheet

| Particulars | Amount (₹) |

|---|---|

| Assets: | |

| Fixed Assets (Machinery, Equipment, Buildings) | XXX |

| Current Assets (Cash, Debtors, Inventory) | XXX |

| Investments | XXX |

| Total Assets | XXX |

| Liabilities & Equity: | |

| Long-term Liabilities (Bank Loans, Bonds) | XXX |

| Current Liabilities (Creditors, Outstanding Expenses) | XXX |

| Owner’s Equity (Capital + Retained Earnings) | XXX |

| Total Liabilities & Equity | XXX |

2. Projected Profit & Loss (P&L) Account

A Projected Profit & Loss Account forecasts the expected revenue, expenses, and profit of a business over a future period. It helps in setting business goals, managing costs, and ensuring profitability.

Format of a Projected Profit & Loss Account

| Particulars | Amount (₹) |

|---|---|

| Revenue: | |

| Sales Revenue (Projected Sales) | XXX |

| Other Income (Interest, Rent, Commissions) | XXX |

| Total Revenue | XXX |

| Expenses: | |

| Cost of Goods Sold (COGS) | XXX |

| Operating Expenses (Rent, Salaries, Utilities) | XXX |

| Marketing & Advertising | XXX |

| Depreciation & Amortization | XXX |

| Interest & Taxes | XXX |

| Total Expenses | XXX |

| Net Profit (Revenue – Expenses) | XXX |

Purpose of a Projected Balance Sheet & P&L Account

✅ Loan & Investor Funding – Required by banks & investors for assessing financial stability.

✅ Business Planning & Growth – Helps in setting revenue goals & expense control.

✅ Budgeting & Cash Flow Management – Ensures proper allocation of financial resources.

✅ Financial Forecasting – Predicts profitability and helps in strategic decision-making.

Reviews

There are no reviews yet.